Self-employment: three months update

some background

I jumped into the world of self-employment as a DevOps freelancer at the beginning of this year. After reviewing my first month was well received by the community I decided to keep this going. Here’s my second update after three months of self-employment.

let’s start with numbers

From my previous three clients two remain. Will go into more detail on that topic in the next section.

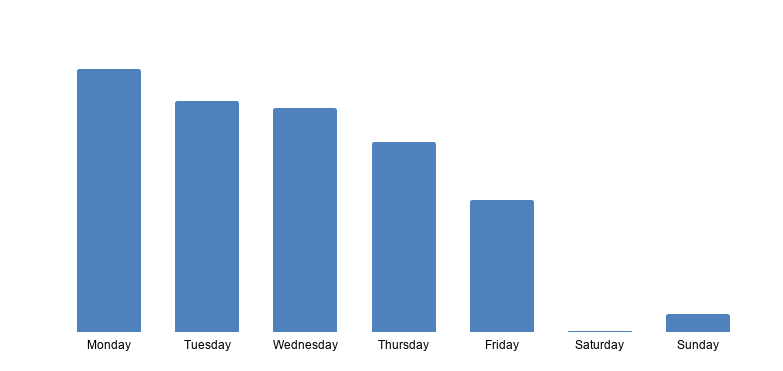

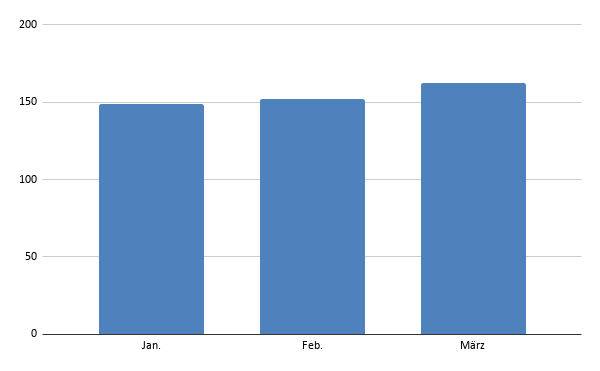

Since the beginning of this year I worked a total of 469.5 hours which makes 156.5 a month and 7.57 per working day. That’s still a pretty average workload in Germany. Let’s have a look at my work time per day of the week.

No visible change here. Still a pretty standard distribution which I don’t think will change any time soon. How about my working hours per month?

Seeing this chart for the first time surprised me a little. From my feeling I worked less and less each month but the raw numbers tell that the exact opposite is the case. Apparently my brain is very good at tricking me into thinking what I want to think.

A key takeaway here, track your time no matter if you bill your clients by hour or by project and be honest to yourself. After all, there are different and more important topics in life than work. 😉

clients come and go

As already said I, finalized working with one of my clients. At the same time other opportunities came up.

After reading my first blog post about self-employment a kind fellow, currently founding a startup, approached me to show me the upcoming open source project he’s working on. While there was no option for me to support them at the moment, I’m really glad to have met him, get to know his product at such an early state and provide some feedback to hopefully make it just a little better.

Similarly after reading my last blog post about wasting money with Kubernetes I was messaged by a really nice guy from an American company. We had two calls during the last weeks, getting to know each other a little and I got a quick glance at their product. Right now we are talking about different ways to collaborate. Let’s see where this will be going. 🙂

Lastly, after attending my city’s monthly meetup of entrepreneurs and self-employed people like usual, I got in contact with a person from a local company. They were currently applying for a prototype fund backed by the German government. I was especially hooked after finding out that the resulting prototype has to be made publicly available. As I’m a huge fan of open source software I did my best to improve their application. Currently crossing fingers that we’ll get the fund and the project can start in autumn.

Why do I tell you all of this? Well mainly cause I want to showcase that you can get to know products, companies and especially human beings from all kinds of sources. Get in contact with people, shout out your more or less professional opinion and join groups that share similar interests. This allows you to open up many opportunities which helps settling your mind in case you get unexpectedly dropped by one of your clients. Additionally having the choice where to go next is always better than depending on that one job you aren’t passionate about.

taxes

Disclaimer: Be aware that I have no kind of qualification when it comes to taxes whatsoever. Everything I’m sharing about this topic is based on my experience and half-hearted research to at least somewhat understand how things work.

This quarter I gained my first experience on how taxes are being handled in Germany if you are self-employed. Two kinds of taxes are important in this case, namely sales (or VAT) and income tax.

The former only applies to sales within Germany and are paid on a monthly basis. Example: I’m selling my DevOps services with a net worth of 1000 € to a German company. They’ll pay me a total amount of 1190 € (19% is the general German sales tax) and I transfer the 119 € to my local finance authority till the beginning of the next month.

For sales within Europe the so called reverse charge mechanism applies. This transfers the responsibility for declaring sales tax to the invoice recipient according to their local tax laws. The same is true if I sell my services to companies outside of the EU.

Income tax on the other hand is based, well as the name suggests on my income. As my total earnings will only be known by the end of the year and authorities don’t want to wait for their tax payments for that long, it’s common to go with an estimation here.

That means communicating something like: “I plan on earning X € during this year.” at the beginning of each year. Based on that number you’ll make income tax payments (of the same amount) per month or in my case per quarter. At the end of the year your final earnings will be determined, the income tax will get calculated, all previous tax transaction will be accumulated and either you or the authorities have to balance out the difference.

As usual, the rate of income tax increases with the amount you earn, combined from all sources (employment, self-employment, real estate income, …). It starts at 0% and goes up all the way to 45%. If you are interested in the detailed numbers check out this Wikipedia article.

payment fees

If you read my first self-employment blog post you may remember me not being sure what I’ll end up paying to be able to receive money in foreign currencies. Turned out it was a lot (>5%).

Paying a high fee just to be able to get money onto your bank account hurts. Especially if you make the calculation back to the amount of time you spent to earn it in the first place. Working 3 days a month just for a bank transfer is a very unsatisfying feeling.

Lessons learned: Clarify how you’ll get paid before joining a client. With platforms like Wise* (formerly: TransferWise) it can be very easy and cheap to pay and get paid from people all across the globe. But in certain countries their service isn’t available (yet). There are alternatives. But expect them to be (way) more expensive.

* affiliate link

conclusion after three months

So how would I describe my three month journey of self-employment? To me it was one hell of a ride with emotions ranging from excitement and curiosity to fear and uncertainty. Leaving a stable, well paying job behind “just” to be able to work under your own guidance is a tough choice.

But as usual, leaving your comfort zone always results in personal growth no matter what’s the outcome. Guess most of you remember the first time approaching that attractive girl/boy, stuttering something of coffee with oat milk foam and park. After doing that X times you get used to it. This is where I am right now after these three months, which is good and bad at the same time.

Getting used to something allows you to free up your mind which enables you to take on new challenges. On the other hand it makes everything, like dating that girl you had a crush on since ages or doubling your paycheck, normal after some time. Let’s wrap it up here before I become to philosophical. Always strive to improve but never forget to appreciate what you already have. 🙂

Self-employment isn’t easy and it’s definitely not for everyone. But I think there are more people that could benefit from it and the demand, at least on the DevOps market, is definitely there. That’s why I’d like to support people going for it. My first step is working out a getting started guide I would have loved to have a few months back.

Feel free to hit me up if you have some questions that you’d like to get answered or topics that I should cover. Until then, stay safe. ✌️